Health insurance is a big stress for many people, especially parents. And today, less children have health insurance coverage than in past years.

Many kids lost coverage when CHIP renewal was up for debate in 2017. And while some were able to get their insurance back, that wasn’t the case for every kid. Last year saw 3.9 million kids without health insurance, up from a low of 3.6 million in 2016.

Image via Magellan Health Insights.

If you’re looking to reduce the cost of your car insurance, it’s important to know where to look. A great place to start looking for better insurance is with your state insurance department’s website which you can easily access at NAIC.org.

This website provides you with advice on how to shop for policies and how to cut down on premiums. Some states have a pricing report or rate comparison table. Check to see if you live in one of the states that has this feature.

Here’s how it works: Find your state, then pick the driver profile that closely matches you and then take a look at the lowest insurance companies that show up.

Image via Baumgart Agencies.

When Wells Fargo opened accounts for more than two million customers without their knowledge, they opened a whole can of worms that complicated things, particularly in terms of people’s credit scores.

Not only did these employees open credit cards in people’s names, but they also opened savings and checking accounts. While those that close the checking and savings accounts won’t experience any negative reflections on their scores, those that close the credit card accounts will.

Here’s why.

If you’re looking to make a big jump in life by taking out a mortgage loan or looking for a new car, then it might be a bad time to cancel those accounts. Canceling cards will always lower your score, but it will matter here most if you’re looking to make a financial change.

Image via Fortune.

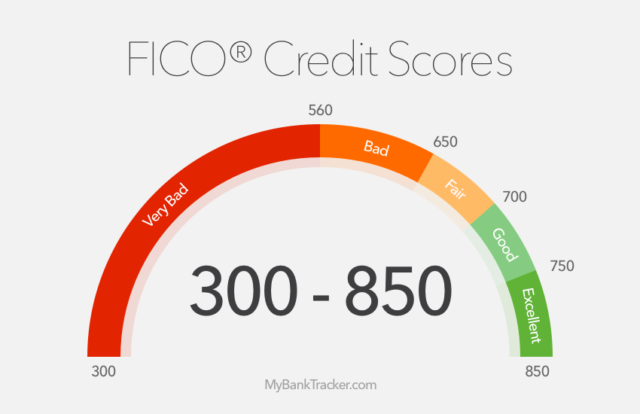

It’s no secret that credit scores have a huge impact on your life and can help make things a lot easier, especially when your score is higher.

The UltraFICO credit score launched in January, and the plan is for it to be more broadly available halfway through the year. It could potentially boost scores for millions of people across the country. With this in place, FICO can also your checking, savings, and money markets to show lenders that you have savings and money to make loan and credit card payments.

Experian Boost will also be released in early 2019 and will allow lenders to review utility bill payments through online bank accounts.

Image via The Financial Clinic.

Recently, $23 million was paid to consumers by credit bureaus. It was alleged that organizations like TransUnion and Equifax had falsely represented the effectiveness of the scores they sold to the public, making it seem as if they were more useful than they actually were. The score that was being sold was the VantageScore.

This isn’t necessarily useless, but sites that Credit Karma also offer your VantageScore when you check them. It never really makes sense to pay for a credit score, and your score is different in different avenues. When it comes down to it, the range of your score is more important than the actual number.

Image via MyBankRate.

Have you ever sat down to read over the fine print of your insurance policies? If you’re like most Americans, the answer is probably no. As it turns out, however, this practice could save you money by uncovering some commonly-held myths about insurance.

Image via Flickr/Barry Bulakites

Continue to original source.

Most homeowner’s insurance products on the market today cover a host of damages stemming from natural disasters, but the Insurance Information Institute reports that flood damage isn’t one of them. Don’t let this information catch you off guard – know whether you should opt for an additional flood insurance policy to protect your home.

Image via Flickr/donita9

Continue to original source.

Since the recession, Americans are generally more credit conscious, and this has led to the average credit score rising steadily for a number of years. Another consequence has been more consumers focused on the goal of perfect credit. Click below to learn how they’re getting there.

Image via Flickr/CafeCredit.com

Continue to original source.

If you’ve never had a credit card of your own, you may be wondering if it’s worth it. The truth is, there are several tips first-time credit cardholders should follow in order to protect their finances and make using a credit card worth their while. Click below to learn the basics of opening and using your first credit card.

Image via Flickr/oguz basyigit

Continue to original source.

There’s all kinds of insurance out there that you may have never heard of, such as athletes loss of value insurance.

In the past, during NFL drafts, several players reportedly collected payouts from insurance policies after they weren’t drafted as early as they had hoped. Policies can range from 6 to 7 figures depending on the player.

See More