Smart Credit Card Habits for Long-Term Financial Health

A Simple Framework for Smarter Credit Card Choices

How to Make Credit Cards Work for Your Budget

MUST READ

How Will Having 2 or More Credit Cards Bring Down Your Score?

Why You Should Have A Mixture Of Credit

Free Credit Reports And Free Credit Scores…What’s The Difference?

FEATURED NEWS

Deciphering Credit Card Terms & Conditions

High Interest Rates On Store Credit Cards

Most Important Items To Check On Your Credit Card Statement

How To Avoid Fraudulent Credit Card Charges

Forms Of Credit Card Interest That’s Tax Deductible

Credit Cards

A Simple Framework for Smarter Credit Card Choices

Balance Transfers Explained: Pros and Cons

Balancing Credit Card Use for Business and Personal Needs

Balancing Credit Card Use for Business and Personal Needs

Building Credit with a Secured Credit Card

Can You Build Credit with a Secured Credit Card?

Credit Scores

How Small Choices Boost Your Credit Over Time

Insurance

Balancing Costs and Care: Senior Insurance Decision Guide

Insurance

Balancing Costs and Care: Senior Insurance Decision Guide

A Practical Roadmap to Planning Later-Life Care Coverage

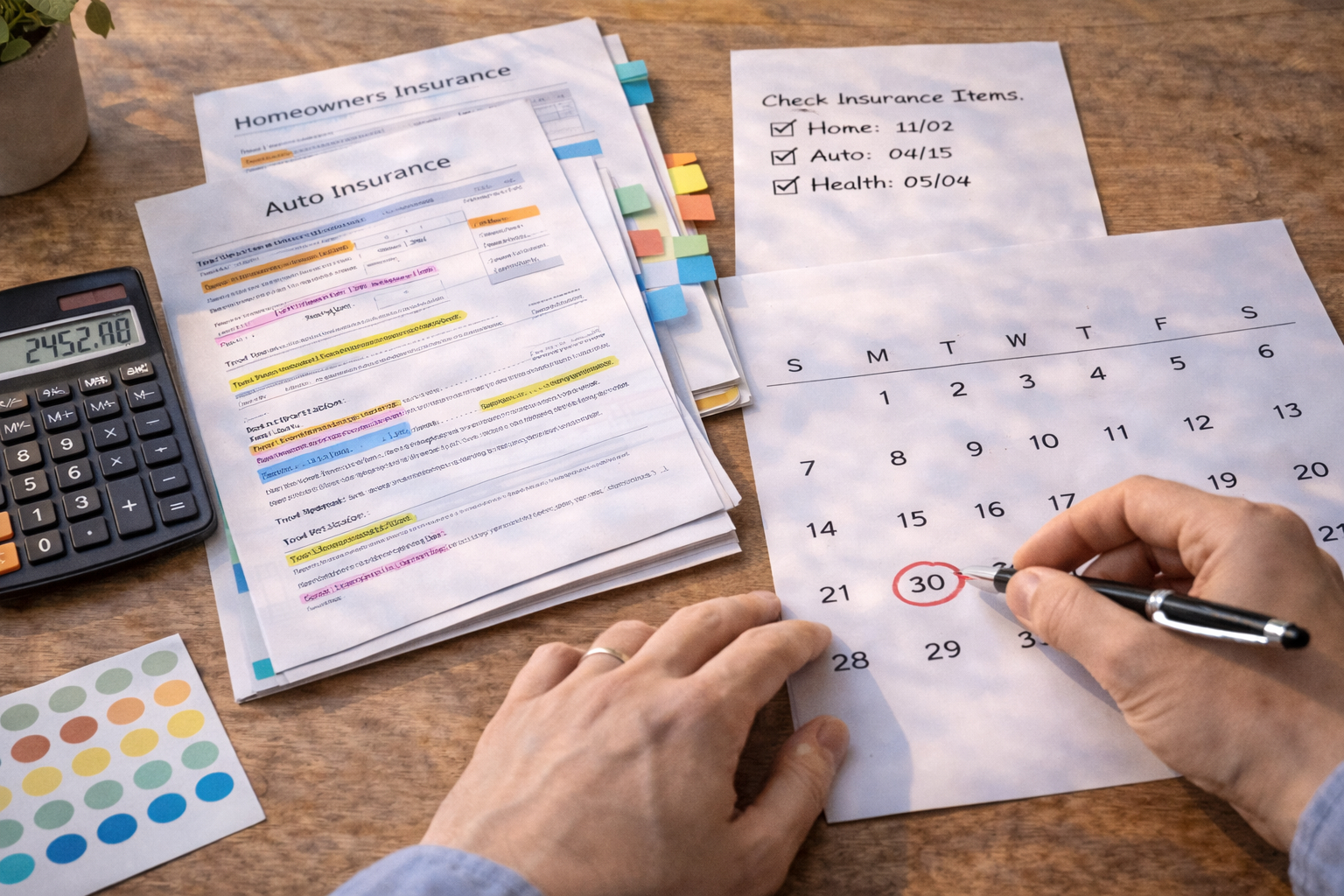

A Balanced Approach to Updating Your Insurance Policies

Making Sense of Senior Care Insurance Options for Families

Practical Guide to Planning Senior Care Insurance Coverage

How to Compare Long-Term Care Coverage Options Effectively

Choosing the Right Senior Care Insurance Plan

How AI Is Helping Insurers Detect Fraud in Real-Time

RECENT NEWS

Top Stories

Archives

- January 2026 (14)

- December 2025 (31)

- November 2025 (30)

- October 2025 (31)

- September 2025 (31)

- August 2025 (17)

- March 2019 (19)

By clicking submit, I authorize Happy Days Plus and its affiliated companies to: (1) use, sell, and share my information for marketing purposes, including cross-context behavioral advertising, as described in our Terms of Service and Privacy Policy, (2) supplement the information that I provide with additional information lawfully obtained from other sources, like demographic data from public sources, interests inferred from web page views, or other data relevant to what might interest me, like past purchase or location data, (3) contact me or enable others to contact me by email with offers for goods and services from any category at the email address provided, and (4) retain my information while I am engaging with marketing messages that I receive and for a reasonable amount of time thereafter. I understand I can opt out at any time through an email that I receive, or by clicking here

-

January 14, 2026

Balancing Costs and Care: Senior Insurance Decision Guide

-

January 13, 2026

A Practical Roadmap to Planning Later-Life Care Coverage

-

January 12, 2026

How Small Choices Boost Your Credit Over Time

-

January 11, 2026

Smart Credit Card Habits for Long-Term Financial Health

-

January 10, 2026

A Balanced Approach to Updating Your Insurance Policies