Choosing senior care insurance requires clear priorities and a realistic assessment of needs. Many families find the options confusing without understanding common policy features and trade-offs. This guide outlines practical considerations that help balance cost, coverage, and future care options. It aims to simplify decisions and support conversations with advisors and family members.

Start by defining short- and long-term goals for care and financial protection. Keeping those goals visible will make comparing plans more productive.

Understanding Policy Types

Policies vary from short-term, expense-reimbursement plans to long-term care policies that cover ongoing services. Some plans offer indemnity payments while others pay only for specific services or providers. Riders and inflation protection can significantly affect premiums and future benefits. Understanding the basic structure helps avoid surprises when care needs change.

Compare how each policy defines covered services and the triggers for benefit payments. Clear definitions reduce uncertainty during claim time.

Assessing Costs and Benefits

Premiums, deductibles, and benefit limits determine the true cost of coverage; look beyond the advertised price. Consider potential premium increases and whether the plan includes options to lock in or reduce future rate shocks. Examine benefit periods and daily limits together with out-of-pocket caps if available. A higher initial cost can be justified if it avoids large unexpected expenses later.

- Monthly or annual premium projections

- Benefit triggers and waiting periods

- Inflation protection and riders

Run scenarios for different care durations to see how each policy performs. This will reveal which plans provide reliable value under realistic conditions.

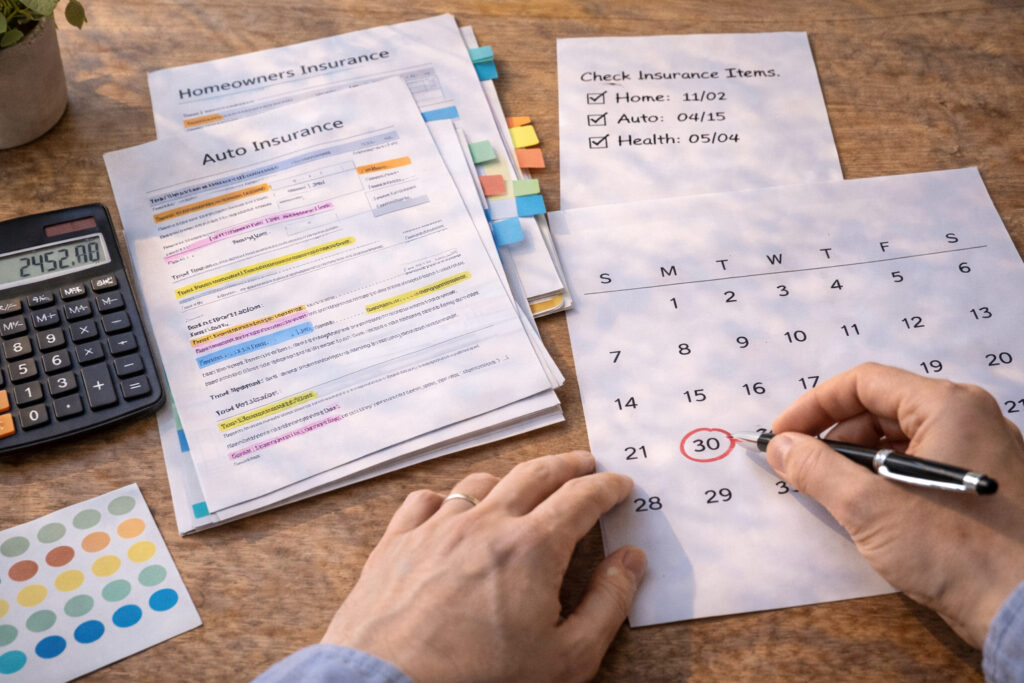

Planning for Future Care Needs

Anticipate how health trends and family support may change over time. Home care, assisted living, and skilled nursing all have different cost profiles and eligibility requirements. Consider hybrid products that combine life insurance with long-term care benefits for flexibility. Planning early often allows better rates and more choices as needs evolve.

Document preferences for care settings and trusted decision-makers. Having a written plan eases transitions and clarifies how insurance fits into broader financial arrangements.

Conclusion

Prioritize needs, compare realistic scenarios, and review policy details closely. Engage family and trusted advisors to test plan assumptions and costs. A thoughtful approach helps protect savings while ensuring access to appropriate care.