Credit cards can be useful financial tools when used with intention and discipline. This article outlines practical approaches to align card use with your budget and goals. You will find guidance on understanding terms, timing payments, and extracting value without overspending. These ideas aim to reduce interest costs, protect your score, and make routine spending more efficient.

Know the Terms and Structure

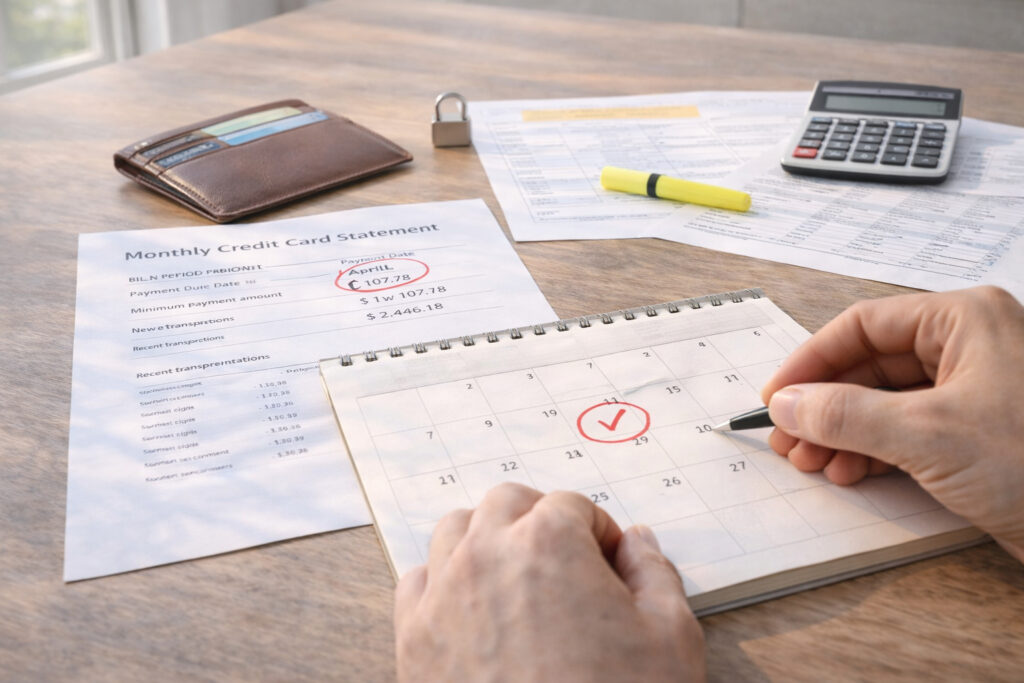

Start by reviewing your card agreement and statements so you understand interest rates, grace periods, and fees. Knowing when interest begins and how minimum payments are calculated prevents surprises that can derail a budget. Pay attention to billing cycles and due dates to avoid late fees and unnecessary interest charges. Clear knowledge of these basics makes it easier to plan spending and payments.

Track key dates and figures in a simple spreadsheet or calendar to stay organized. This small habit reduces stress and helps you adapt card use to cash flow.

Adopt Practical Payment Habits

Prioritize paying the statement balance in full each month to maintain the grace period and avoid interest on purchases. If you cannot pay in full, aim to pay more than the minimum to reduce interest costs and shorten repayment time. Set up automatic payments for at least the minimum to safeguard your score and prevent late fees. Regularly reviewing spending categories helps you identify charges you can trim or reallocate within your budget.

Consistent, proactive payment behavior is one of the fastest ways to build long-term financial stability. Small, steady improvements compound and make managing multiple accounts simpler.

Maximize Benefits Without Overspending

Use rewards and benefits intentionally rather than letting them dictate purchases. Choose one or two cards that align with your most common expenses and optimize category rewards without chasing every bonus. Be mindful of annual fees; only keep cards whose perks exceed their cost for your situation. Consider cash-back or flexible travel rewards that naturally match your spending patterns.

Redeem rewards regularly and factor them into your budget as occasional offsets rather than new spending incentives. Thoughtful use turns rewards into genuine savings.

Conclusion

Align card choice, payment timing, and reward use with your monthly budget to gain control and avoid debt. Simple systems like automatic payments and regular reviews reduce stress and improve outcomes. Over time, disciplined habits translate into better credit standing and more financial flexibility.