Credit cards can be powerful tools when used intentionally to support a stronger credit profile and better financial flexibility. With thoughtful planning, everyday spending can contribute to improved scores, lower borrowing costs, and greater financial options. This article outlines practical, sustainable steps that prioritize responsible use and gradual improvement. The guidance focuses on habits and monitoring rather than quick fixes or risky strategies.

These approaches are designed to work alongside a broader budget and savings plan. They are adaptable whether you are starting out or rebuilding over time.

Understand the fundamentals of credit and cards

Before changing behaviors, it helps to understand the key factors that influence credit evaluations, such as payment history, utilization, account age, and account mix. Knowing how timely payments and the proportion of available credit you use affect your score will inform day-to-day decisions. Different card types and issuer practices can also impact how activity is reported, so familiarize yourself with statements and reporting cycles. This foundation reduces surprises and supports consistent improvement.

Learning these basics takes a little time but pays off by making each decision intentional. Clear knowledge helps you prioritize actions that have the biggest long-term impact.

Adopt consistent, responsible card habits

Establishing reliable routines is central to improving credit with cards: pay all balances on time, avoid carrying high balances relative to limits, and use cards for predictable expenses you can repay. Small practices such as scheduling automatic minimum payments and setting reminders for full payments prevent missed deadlines and late fees. Keeping individual card utilization low — ideally well under half of the available limit — demonstrates responsible credit management to scoring models. Diversifying activity across accounts carefully can show a healthy credit mix without creating unnecessary new inquiries.

- Pay on time every month; set autopay for at least the minimum.

- Keep utilization low by spreading balances or paying mid-cycle.

- Avoid opening unnecessary accounts; focus on long-term stability.

These habits reduce risk and build a track record that scoring systems recognize. Over months and years, consistent behavior produces measurable gains.

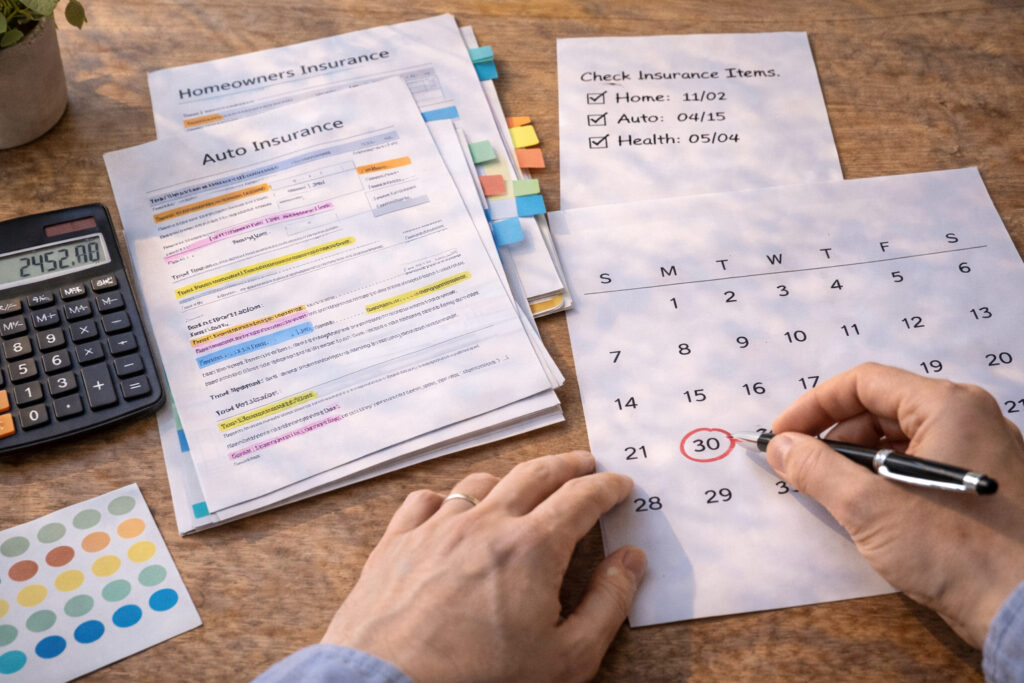

Monitor progress and expand strategically

Regular monitoring helps you spot errors, identity theft, or reporting issues that could hold back progress, so review statements and credit reports periodically. Use alerts and reputable monitoring tools to stay informed about balance changes and new accounts. When considering a new card or higher limit, weigh how it will affect your utilization, credit mix, and whether a hard inquiry is warranted. Strategic decisions—such as requesting higher limits on established cards or keeping older accounts open—can support steady score improvement.

Make changes deliberately and evaluate results over several billing cycles. Patience and small, consistent adjustments typically yield the best outcomes.

Conclusion

Using credit cards to improve financial health is about steady, informed habits rather than shortcuts. Consistent on-time payments, mindful utilization, and regular monitoring create sustainable progress over time. Stay focused on long-term stability and adjust strategies as your financial situation evolves.