Choosing the right personal insurance can feel overwhelming, but a clear approach makes decisions easier. This article breaks down practical considerations to help you assess options and prioritize protection. With straightforward guidance, you can evaluate policies with confidence and avoid common missteps. The aim is to provide useful, actionable information for better coverage choices.

Understanding Your Policy Options

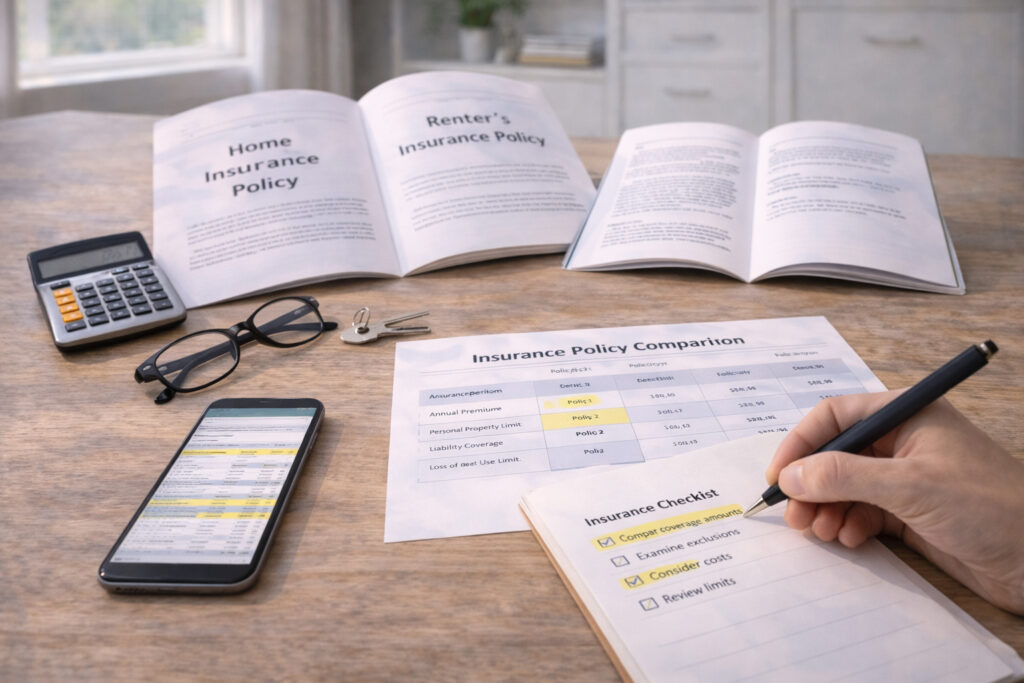

Insurance products are built from several basic components: the types of coverage, policy limits, deductibles, and exclusions. Learning how these elements interact helps you balance cost against the level of protection you need. Consider the scenarios you want covered and whether standard policies meet those needs or if endorsements are required to fill gaps. Reviewing sample policies and asking targeted questions will clarify what each option truly provides.

Once you understand the core elements, map them to your personal situation and risk tolerance. Keep records of priorities so you can compare meaningful differences rather than getting distracted by marketing language.

Tips to Compare Quotes Effectively

When comparing quotes, focus on apples-to-apples comparisons by checking limits, deductibles, and covered perils rather than just premiums. Use a checklist to ensure each quote addresses identical coverage features and any optional endorsements that matter to you. Pay attention to insurer reputation for claims handling and financial stability, since the cheapest premium can become costly if claims are poorly managed. Also inquire about discounts and bundling options that are relevant and clearly documented.

Document the choices and assumptions behind each quote so that you can revisit them later if circumstances change. A systematic comparison reduces guesswork and highlights trade-offs between cost and coverage.

Avoiding Common Coverage Pitfalls

Many people discover gaps in coverage only after an incident occurs; typical pitfalls include underinsuring valuables, overlooking exclusions, and assuming seasonal or recreational risks are covered. Pay particular attention to aggregate limits and sub-limits that can limit recovery in certain claims. Read the policy language around exclusions and endorsements and ask an agent to explain anything unclear. Regularly updating your coverage as life changes—such as acquiring new assets or changing living arrangements—prevents unexpected shortfalls.

Maintaining an inventory of assets and reviewing policies annually helps you spot gaps early. Proactive management of coverage reduces the chance of unpleasant surprises when filing a claim.

Conclusion

Careful comparison and a clear understanding of policy details are the best tools for smart insurance decisions. Focus on matching coverage to your risks and document the reasons behind each choice. Regular reviews ensure your protection keeps pace with changes in your life.