Improving a credit score takes consistent, informed choices rather than dramatic moves.

Small actions repeated over months and years create measurable improvement.

A reliable framework helps prioritize behaviors that influence scoring models.

This article outlines practical steps you can adopt and sustain to build credit health.

Start with manageable habits and iterate as your situation changes.

Why a healthy credit score matters

A healthy credit score expands access to lower interest rates, better loan terms, and more financial options. It affects not only borrowing costs but also how lenders view overall risk, which can influence approvals and deposits. Employers, landlords, and insurers sometimes review credit information, making it a broader indicator of financial responsibility. Understanding the role of a score clarifies why steady improvement is valuable and worth systematic attention.

Focusing on score improvement is less about chasing a single number and more about improving financial flexibility.

When you treat credit as a tool, you make decisions that support long-term goals.

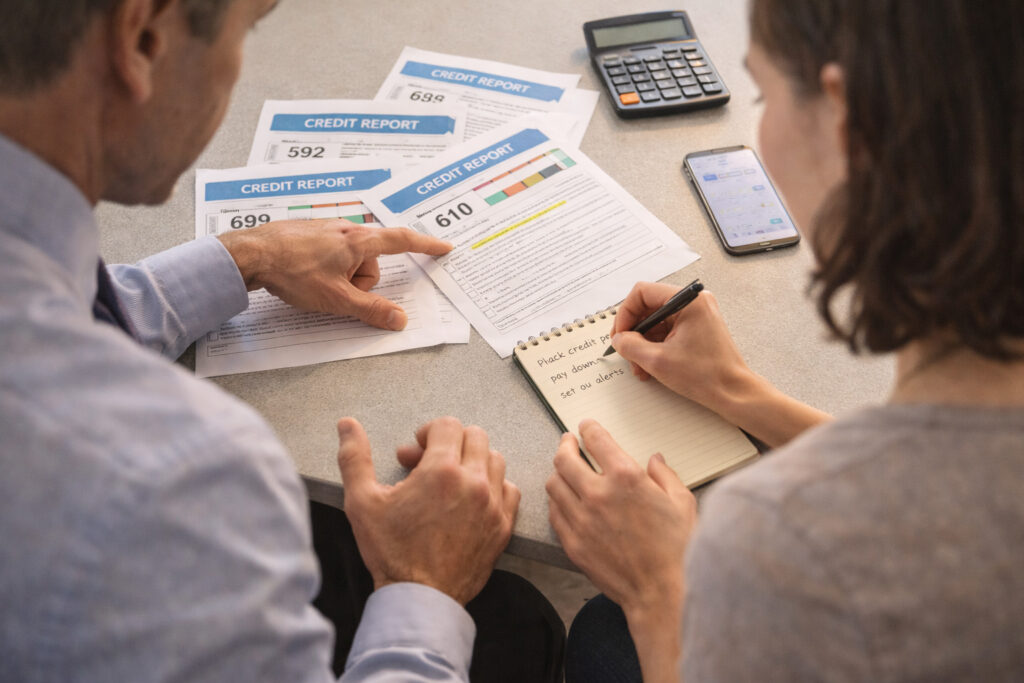

Daily actions that add up

Adopting predictable daily and monthly habits is the most reliable way to influence your score. Pay bills on time, maintain low balances relative to limits, and avoid closing older accounts that contribute to credit history length. Keep new credit applications selective; each hard inquiry can have a short-term effect. Over time, consistent on-time payments and reasonable utilization are among the strongest drivers of upward movement.

- Set automatic payments or calendar reminders to avoid missed bills.

- Target utilization under 30%, and lower when preparing for major credit needs.

- Limit new account applications to when you genuinely need credit.

These habits are straightforward but require discipline and tracking.

Small operational changes remove friction and make positive outcomes more likely.

Monitor, correct, and adapt

Regularly review credit reports from available sources to confirm accuracy and spot unfamiliar accounts or errors. Dispute mistakes promptly using the reporting agency processes and keep records of communications. If a late payment or high balance appears, contact creditors to understand options like payment plans or hardship programs. Adjust your plan as life changes, for example when income shifts or you take on a mortgage.

Monitoring gives you control and early warning of issues that could drag scores down.

Adapting your behaviors in response to insights leads to sustained improvement.

Conclusion

Consistent, intentional habits form the backbone of credit improvement.

Monitor your reports, act on inaccuracies, and prioritize on-time payments.

Over time, these steps create measurable and lasting gains in credit health.